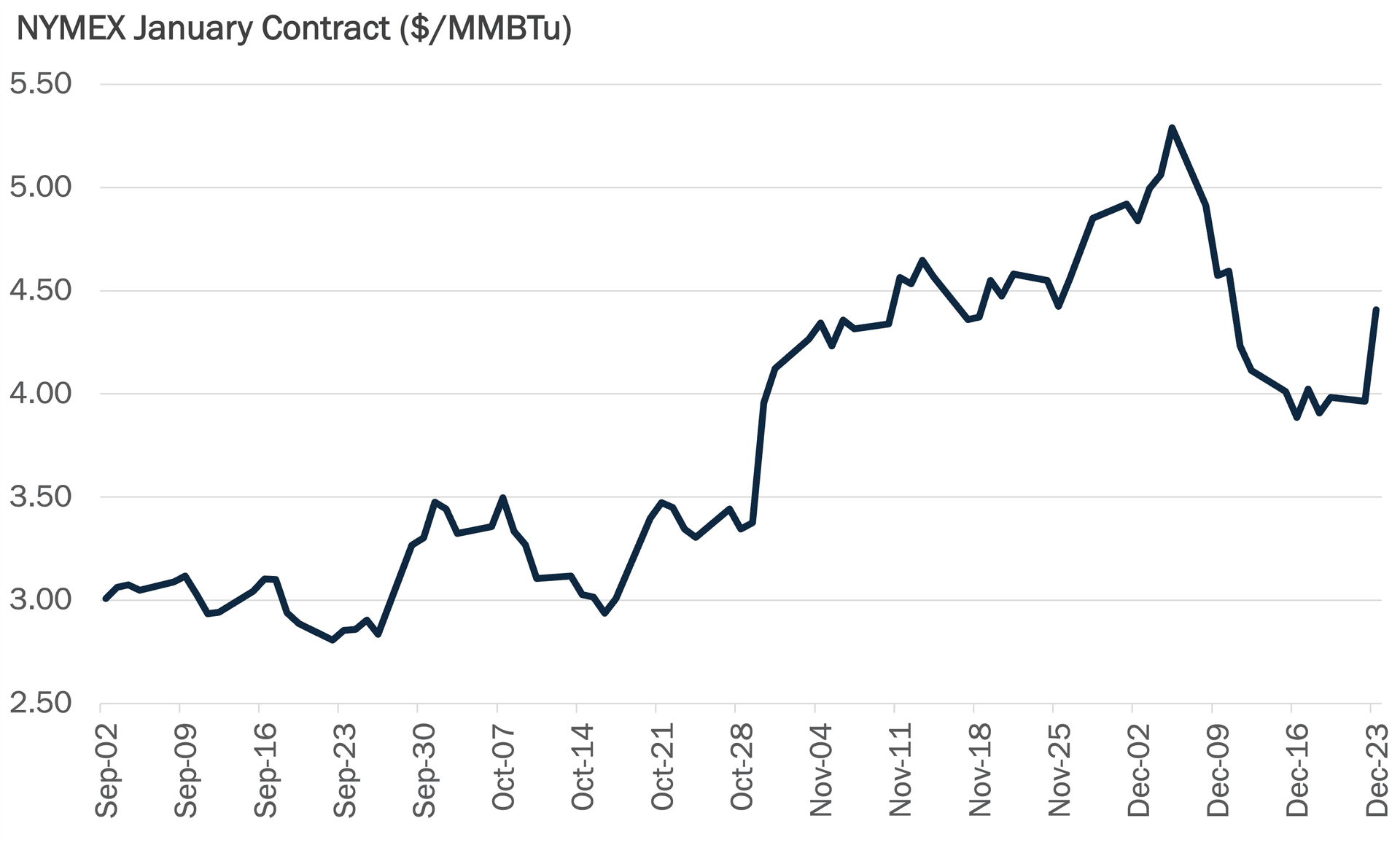

Gas Explodes Higher as Weather Tightens and Shorts Scramble

A colder turn in the late December outlook, paired with nervous positioning ahead of January expiration, is driving a violent snapback in the front of the curve. January's contract is up a whopping 47 cents day over day, a 12% surge, trading near $4.43/MMBtu after yesterday’s $3.96/MMBtu close. That is the kind of move that instantly changes the mood on the screen, gaining nearly half a dollar in one session, and typically only shows up when the market is leaning the wrong way. After days of steady selling, traders were prepared for additional downside. Now that weather forecasts added heating demand in the East, suddenly everyone wanted out at the same time. Add in the usual holiday storage uncertainty and the result is a fast, vertical rally that feels less like a measured reprice and more like a rush to cover.

The bigger picture is still a tug of war between very strong supply and winter volatility that can flip in a single model run. Production remains near record territory, but the demand side has been loud enough to matter again, with residential and commercial load firming and LNG feedgas recovering from a brief lull. Storage expectations are also back in focus, with traders bracing for another sizeable withdrawal that keeps the market sensitive to any incremental cold. For now, this looks like a market that tried to get too comfortable with warmth and got punished, which is why price can be both expensive and fragile at the same time. Separately, policy headlines are adding some longer term texture to the power story, with the Trump administration moving to halt offshore wind projects under Interior Secretary Doug Burgum, a shift that could keep gas fired generation in the conversation longer than initially assumed.

NYMEX Natural Gas January Contract Trading at $4.44/MMBtu

Oil Rebounds Modestly as Risk Premium Returns

WTI is at $58.42/bbl, up 0.71% since yesterday's close, as the market claws back a little ground on renewed supply anxiety tied to Venezuela and the broader Russia and Ukraine backdrop. After a brutal stretch that pushed crude toward multi year lows, even a modest increase in perceived disruption risk can spark quick buying, especially when positioning is already leaning heavily bearish and traders are looking for reasons to cover. The bounce still feels fragile because the bigger weight on this market has not gone away. Expectations for comfortable global supply and an uneven demand picture continue to keep rallies contained, so this move reads more like a relief pop on risk premium than the start of a clean trend higher.

If you enjoyed this article, consider subscribing to our Free Gas Daily Newsletter or one of our Online Reports

Keep Reading

More from Gelber & Associates

G&A Predicts 165 Bcf Withdrawal From Storage

Analysts see a very wide 135–195 Bcf range for this week’s EIA report with Gelber & Associates landing at a 165 Bcf withdrawal for the week ended December 5.

PetroReconcavo Nudges Brazilian Onshore Output Higher

January NYMEX is trading near $4.93/MMBtu this morning, down a fair margin from Friday’s $5.23 close as futures give back part of their hefty weather-driven gains.