Five-Year Natural Gas Basis Forecast

Multi-Client Analysis

Natural gas supply and demand has been turned on its head. The biggest impact of 2020 has been a remarkable decline in drilling in most key basins. The COVID-19 pandemic has had far reaching effects on both natural gas production and demand, both in abrupt, short-term shocks and changes to longer-term growth prospects. Midstream development has all but temporarily halted in this crisis. Natural gas demand, which was supposed to undergo steady growth in the year of 2020, has instead contracted slightly in the face of this unprecedented obstacle. The problem is that key basis points will change value dramatically over the next five years. Futures prices are mispriced and basis values fail to reflect the true picture.

This forecast is an independent analysis on the price and basis implications of these changes from the start of 2021 until the end of 2025.

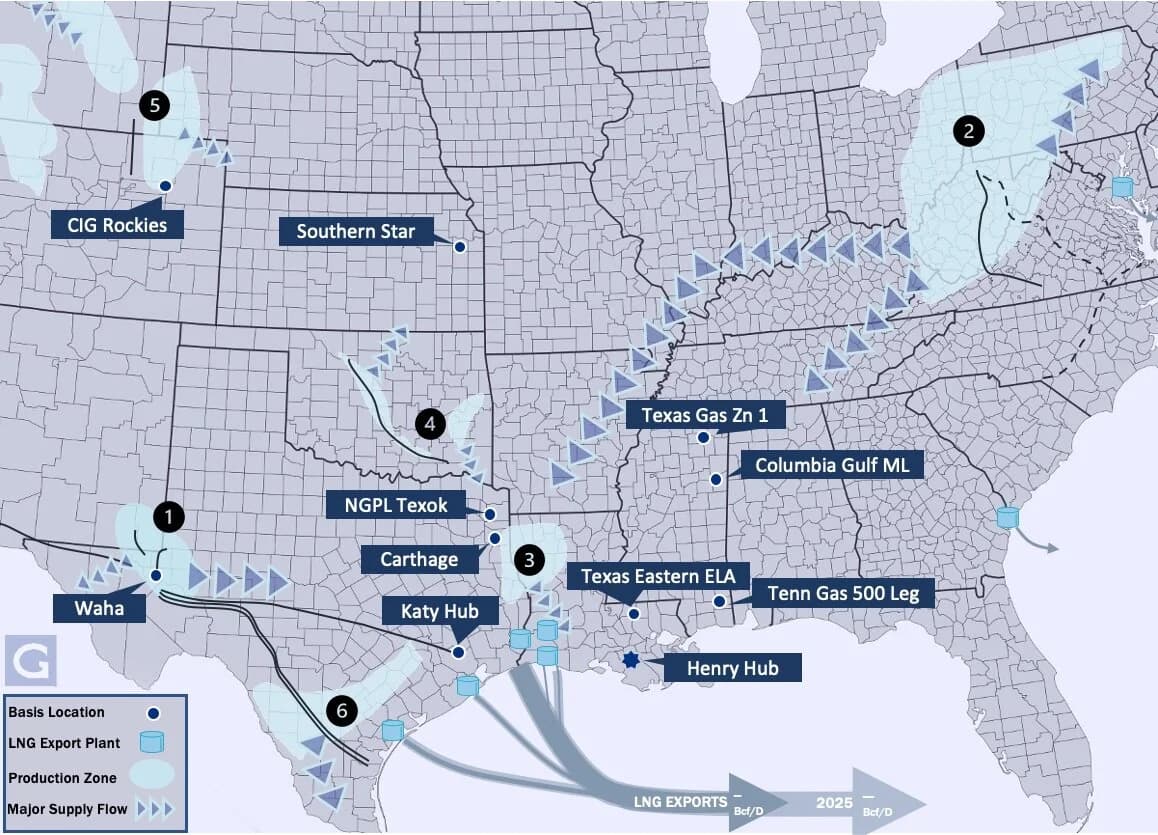

The basis markets analyzed are as follows:

- REX Zone 3

- NGPL Texok

- Southern Star

- Waha Hub

- Katy Hub

- Tennessee 500-Leg

- TX Eastern ELA

- Texas Gas Zone 1

- NYMEX Henry Hub

- And more!

Additional basis points may be forecasted upon request.

Analysis of such locations provides a forecast of the basis differential to Henry Hub, offering insight into the market and identifying potential procurement savings and trading opportunities. Our 5-year forecast contains both a presentation with high definition charts and maps as well as a supplementary text document with detailed information. Gelber’s 5-Year forecast also contains a regional breakdown of each major producing region, US and Mexico midstream market outlooks and maps, LNG analysis, renewable energy analysis, supply-demand fundamentals, and more! Gelber & Associates, natural gas advisor and consultants to the industry for 30 years, is completing a special Forecast to help clients and customers get a respected, independent view of how these price shifts will impact their business.

Where are the new pipelines? How are the major midstream companies integrating their assets and interconnects? What gas flows first, what gas in incremental, how much expansion is likely at various LNG projects, will Henry Hub stay a premium point, or will basis begin to strengthen as drilling slows and demand rises?

The Gelber Natural Gas 5-Year NYMEX and Basis Forecast is available now, competitively priced at $5,000 with introductory offers and previous subscriber discounts also available.

If you would like to purchase this forecast, or inquire about additional information and other editions, please contact [email protected], call us at (713) 655-7000, or message us here.

Latest Articles

EIA Reports -177 Bcf Withdrawal From Storage for Week Ended Dec. 5

The January NYMEX contract is trading near $4.22/MMBtu after a soft storage day, sliding from yesterday’s $4.60 close. Prices were hovering around $4.39 ahead of the EIA release, dropped to roughly $4.30 on the print, and have continued to drift lower as the market gives back more of last week’s weather-led spike.

G&A Predicts 165 Bcf Withdrawal From Storage

Analysts see a very wide 135–195 Bcf range for this week’s EIA report with Gelber & Associates landing at a 165 Bcf withdrawal for the week ended December 5.